Services for Business Lenders

UCC Search | UCC Filing | UCC Monitoring | Secured Party Representation | PMSI | Online Portfolio Management

Streamlined UCC Solutions for Commercial Lenders

As a Commercial Bank, you provide loans secured by hard collateral to help businesses fund their operations or other large capital expenditures they would otherwise be unable to support. First Corporate Solutions (FCS) works diligently to design products and services that specifically address your business requirements. The FCS fleet of services empowers you to evaluate applicants quickly, monitor existing customers and close transactions with confidence and ease.

Corporate Solutions (FCS) works diligently to design products and services that specifically address your business requirements. The FCS fleet of services empowers you to evaluate applicants quickly, monitor existing customers and close transactions with confidence and ease.

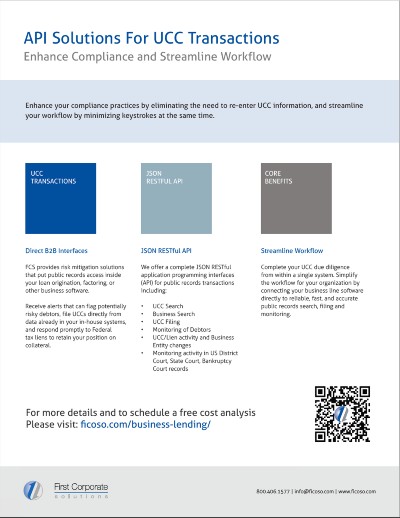

API For UCC: Enhance Compliance While Eliminating Costly Errors

Today, more than ever, lenders are focused on minimizing their risks when entering a financial transaction.

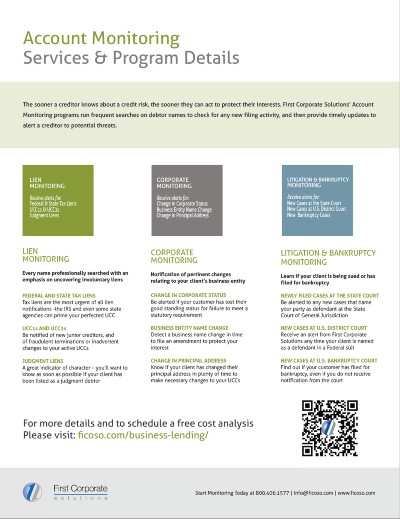

As economic impacts continue to mitigate, many financial institutions are now reducing their risk forecast for loan defaults. The upbeat sentiments are welcome but the times remain unprecedented, and uncertainty remains on what lies ahead.

Two key components in the lenders’ due diligence process when entering a transaction are conducting consensual and non-consensual lien searches, and filing a UCC1 against the borrower.

Approximately 20% of all UCC filings have an error which can impact a lender’s lien position in the borrower’s collateral. Many of these errors are human rekeying mistakes which technology can eliminate, and mid-size and large lenders are looking at technology solutions like API for UCC to do just that: eliminate rekeying errors.

There is another key benefit API for UCC delivers; valuable time for lenders and their associates is freed up to invest in other value-added steps within the due diligence process. API for UCC vastly reduces the human resources required to rekey data and manually manage UCC filing processes… [read more]

“FCS online system really helped us manage our transactions and cut costs. I get what I need at my fingertips, accurately and easily. And when I need to contact someone there’s always an actual person who responds.”

Natalie M., Credit Manager, National Bank (IL)

Signup for a Free Cost Analysis

Fill out the form below for a free cost analysis of your current UCC expenses.