Do risks to your perfected security interest end with Federal tax liens and pre-lien IRS related threats?

UCC

Do risks to your perfected security interest end with Federal tax liens and pre-lien IRS related threats? The simple answer is No. Some would seem to have you believe the opposite is true, but it’s not.

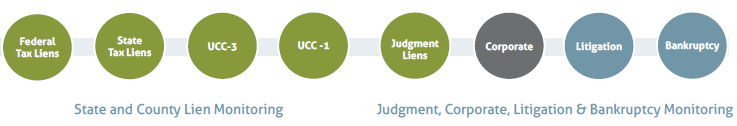

For example, last week we discussed how judgment liens can prime a previously perfected security interest. If you missed that post you can check it out here. But that’s not all. In some states, State tax liens can also potentially prime a perfected security interest. Consult legal counsel for specifics state by state.

And there’s more. Non-lien related public record events can also cause a financing statement to become ineffective with a loss of perfection. For example, a debtor name change, or business structure change, or debtor relocation to a new jurisdiction, all have the ability to cause a previously perfected security interest to become ineffective.

And none of this even begins to discuss the priority effects of liens and other public records that exist prior to the filing of a secured party’s financing statement and are not IRS related.

Only a thorough due diligence search of public records can uncover and inform a secured party of the many threats that exist to perfecting a security interest and then maintain that perfection going forward. Information derived solely from interactions with the IRS is not enough.

Consider partnering with a public records company that specializes in alerting secured parties to threats to their security interests by uncovering these various threats as they appear in the public record after perfection, and also by reporting the threats that exist prior to perfection.

Information gained from the IRS, while undoubtedly critical, is not close to enough.