Delaware Corporations: Franchise Taxes & Annual Reports due March 1st, 2019

Corporate, UncategorizedFor-profit and nonprofit corporations in Delaware should be on the lookout for notices from the Delaware Division of Corporations for franchise taxes and annual reports due for the 2018 tax year. Not receiving this notice does not exempt you from filing and paying by the due date.

Following the 2017 amendments to Title 8 Section 503 many corporations have been left with questions. We’ve assembled a list of facts to consider during your annual filing.

How to File

All annual franchise tax reports must be filed electronically with the Delaware Division of Corporations and paid only in U.S. dollars drawn from U.S. banks.

Payment options include:

– Visa, MasterCard, Discover, American Express

– ACH Debit (required for transactions over $5,000)

**Support available online 8:30 AM to 4:00 PM ET on weekdays. For urgent matters, contact the Division of Corporations Franchise Tax Section at (302) 739-3073.**

What’s Due

A fully completed annual report and payment for both the annual report filing fee and franchise tax by March 1st, 2019. Exempt corporations do not have to pay franchise tax.

Information Required

Annual reports are pre-populated with certain information like exact legal name of the entity, total number of authorized shares, class and par value of the shares, and a franchise tax and fees breakdown.

The annual report is also required to include

– principal business address and phone number

– names and addresses of all directors

– name and address of one officer.

Authorized Signer

The corporation’s president, secretary, treasurer or other duly authorized officer, or by any of its directors must sign the annual report. The authorized signer for initial reports can be any incorporator if the board of directors have not been elected but cannot sign subsequent reports.

Delaware Franchise Tax Calculation

Corporations pay the lesser of the two methods used to calculate their franchise tax, as shown below. You can use the franchise tax calculator to help estimate what you may owe or learn more about your options using either the Authorized Shares or Assumed Par Value methods.

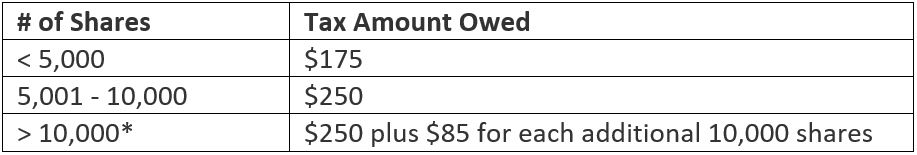

Authorized Shares Method

Assumed Par Value Method

This methods tax rate is $400 per $1,000,000 (or part thereof) of the assumed par value capital, with a maximum annual tax of $200,000.

To use this method the following for the fiscal year must be reported:

– total number of issued shares (including treasury shares)

– total gross assets listed on Schedule L (Form 1120)

All non-exempt non-stock corporations pay a franchise tax of $175.

Fees

An additional annual report filing fee of $50 is charged by the Delaware Secretary of State. Exempt corporations pay $25 to file an annual report.

Quarterly Franchise Tax Payments

Corporations that owe $5,000 or more can pay their estimated taxes in the following quarterly installments:

– 40% due on or by June 1st

– 20% due on or by September 1st

– 20% due on or by December 1st

– the remainder due March 1st

A reminder notice will be sent to corporations paying their franchise taxes quarterly. Only one annual report is due on or by March 1st.

Missed Deadlines

Failure to file the annual report by March 1st:

– Good Standing Certificates will not be issued

– $125 penalty plus a 1.5% interest per month (applied to unpaid tax balance and original tax and annual report fees)

Failure to file and pay after 2 years:

– the corporation’s Certificate of Incorporation will be revoked.

Unengaged Domestic Corporations

Domestic corporations that were never engaged are still required to file the annual report and pay the franchise tax.

Mergers & Dissolutions

Annual report(s) must be current prior to all dissolution and merger filings and all franchise taxes must be paid through the date of the filing of the Certificate of Dissolution or Merger with the Delaware Secretary of State. It’s recommended to identify the tax due in these cases well in advance of the date of filing for a dissolution or merger.

**This blog is for informational purposes only and should not be interpreted as legal advice. First Corporate Solutions is diligent in our efforts to perform thorough research and provide you with the most recent and relevant information available. However, due to jurisdictional variances and evolving public records statute, we can accept no liability in terms of the accuracy of the information contained herein.**